Cyber insurance - what you need to know

Why Cyber Insurance doesn't make sense: Brian Snow’s Warning About Insuring Against Intelligent Attackers

Cyber insurance has quickly become a popular solution for organizations hoping to safeguard their businesses from the growing threat of cyberattacks. From ransomware demands to data breaches, many believe that a policy can act as a financial safety net. However, Brian Snow—a renowned cryptographer and former Technical Director at the U.S. National Security Agency—raises deep concerns about the very foundation of cyber insurance. Simply put, Snow argues that the cyber risk landscape is fundamentally different from the risks tackled by traditional insurance because it is defined by intelligent attackers, not random, inanimate forces like tsunamis or earthquakes[1][2].

Cyber Risks Are Unlike Natural Disasters

Most forms of insurance work by analyzing historical data and predicting the frequency of events like fires, floods, or earthquakes. These are natural disasters: they happen randomly, they don’t adapt or plot against you, and their damage can be quantified by statistical models.

Cyber risks, Snow emphasizes, are not like this. In the cyber world, the threats come from human adversaries—intelligent agents—who actively study and exploit weaknesses. These attackers aren’t random at all. They’re relentless, creative, and constantly adapt to every new security measure, every new insurance policy criterion, and every response defenders try to deploy.

Snow explains that most digital infrastructure was built with an assumption: users are honest, and the Internet should be easy and cheap to use. Security was added as an afterthought, if at all. This resulted in systems that rely heavily on trust, instead of robust engineering to resist malice.

“By design, the Internet naïvely relies on the honesty of every network user, and places far too little emphasis on healthy mutual suspicion! ... The cost and risks were not eliminated—rather they were shifted away from the designers and the manufacturers, and transferred to the global user base.”

— Brian Snow [1]

Insurance Logic Breaks Down in Cyber

Traditional insurance is calculated by assessing risk exposure: How often does an event happen? How much damage does it cause? Attacks by intelligent adversaries break those rules. With every new insurance product, attackers adapt—sometimes targeting businesses specifically because they have insurance to ransom.

Snow makes this analogy clear: insuring against cyber risk is not like insuring against the unpredictable power of a tsunami or earthquake. Tsunamis don't "learn" how to bypass flood walls. Hackers do learn how to bypass firewalls.

“Your cyber systems continue to function and serve you NOT due to the EXPERTISE of your security staff, but solely due to the SUFFERANCE of your opponents.”

— Brian Snow [2]

That means you’re protected only because, so far, no one with enough skill and motivation has struck. Cyber insurance can't change this basic dynamic—it can only pay out after the attack.

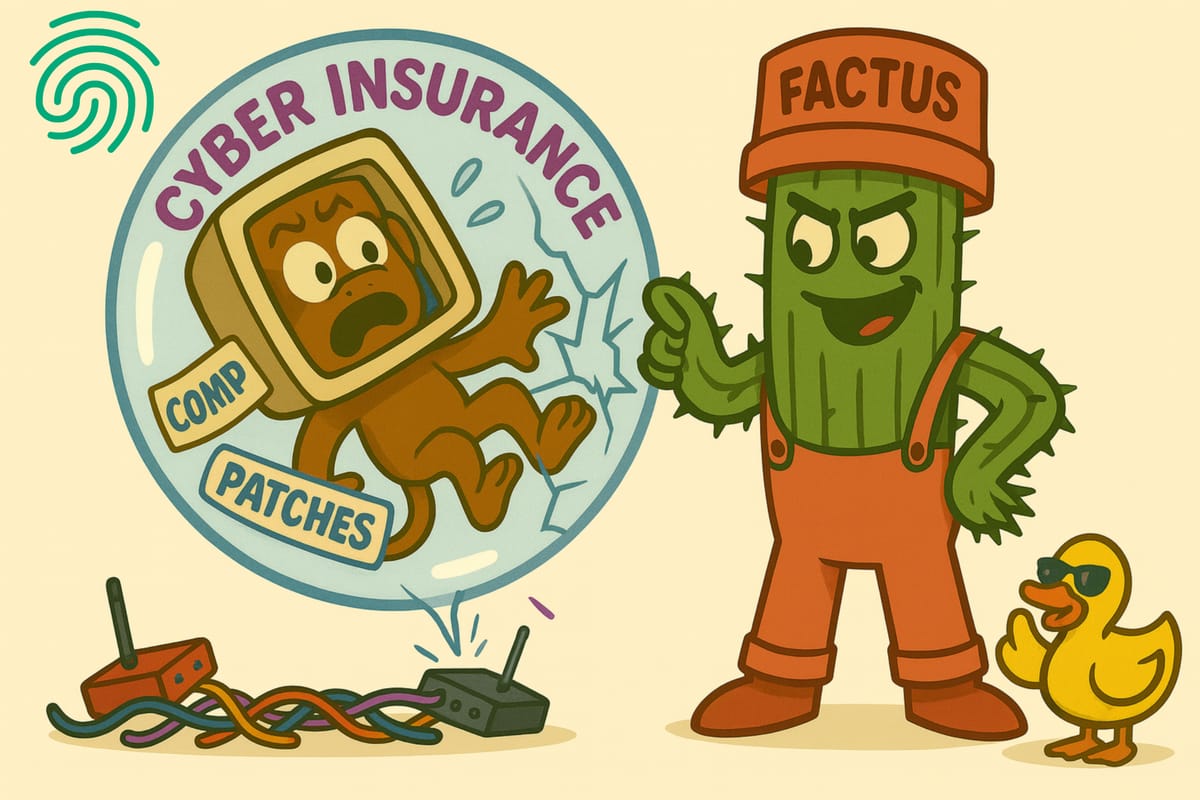

The “Trust Bubble” Problem

Snow labels our collective dependence on digital trust as a “trust bubble.” We act as if our systems are secure—trusting vendors, networks, and software—but that trust is usually misplaced. Most products and platforms include a “pile of crippling un-addressed conceptual and implementation debt,” meaning flaws and weaknesses that mount over time, quietly ignored. Insurance does nothing to fix these underlying issues.

A “trust bubble” is just like a financial bubble: everyone feels safe until, one day, it bursts. Snow warns that a major cyber meltdown could have global effects similar to the 2008 financial crisis, eroding trust in digital systems everywhere[1].

Why Insurance Can Foster Complacency

Imagine believing you’re safe from fire just because you have fire insurance, even though your house has faulty wiring and you never check the smoke alarms. Cyber insurance can give the same false sense of security. Companies might buy coverage, tick boxes on a compliance list, and skip the hard work of actually building resilient, attack-resistant systems.

Snow criticizes an industry more interested in superficial fixes and passing audits than real security. The rising complexity of digital infrastructure (and the shortcuts taken) only increase our vulnerability. Insurance, in this view, may delay necessary reforms, not drive them.

The Path Forward: Security by Design

Snow’s message isn’t all bleak. He’s adamant that real security must be built into systems from the ground up—not added as an afterthought, and never replaced by insurance alone. Security teams should assume adversaries are smart, creative, and determined. Systems must be designed for resilience, with the expectation that attackers will adapt and evolve.

This means:

- Prioritizing fundamental fixes over compliance checklists.

- Building transparency into how risk is defined, measured, and insured.

- Accepting that cyber insurance is a last layer of support, not a substitute for strong security investments.

What This Means in Plain Language

Think of it this way: cyber insurance is not like flood or fire insurance. Floods don’t read your insurance policies and find ways to breach your defenses. Hackers do. And as long as digital systems rely on outdated designs and misplaced trust, no insurance policy can guarantee safety against intelligent, adaptive adversaries. True protection comes from accepting this reality and designing systems for active defense.

Clear Sourcing and Authority

This article draws upon:

- Brian Snow’s written and spoken warnings, including submissions to the U.S. Commission on Enhancing National Cybersecurity[1].

- Commentary and analysis by security experts like Bruce Schneier, who has covered Snow’s views and their significance for business and government[2].

The quotes above are sourced directly from Snow’s published testimony and expert commentary, which emphasize that insurance may manage costs after the fact but cannot stop attacks driven by thinking adversaries.

References within article:

[1]: Brian Snow – Submission to the U.S. Commission on Enhancing National Cybersecurity (Synaptic Labs/NIST)

[2]: Bruce Schneier blog commentary on Brian Snow’s warnings

This perspective is essential for every leader, decision maker, or security professional considering cyber insurance. Understand the unique nature of cyber risk—and the limitations of traditional insurance logic—before placing your trust in a policy rather than in the strength of your systems and security team.

Sources

[1] Risky Business #144 -- Brian Snow on PKI's failure to deliver https://www.risky.biz/RB144/

[2] Brian Snow - Wikipedia https://en.wikipedia.org/wiki/Brian_Snow